Conclusion

This project demonstrates the application of machine learning techniques to predict stock prices. Gradient descent optimization provided better performance compared to simple linear regression. PCA effectively reduced dimensionality, enhancing model performance. Future work involves exploring more advanced models such as LSTM and reinforcement learning for stock prediction.

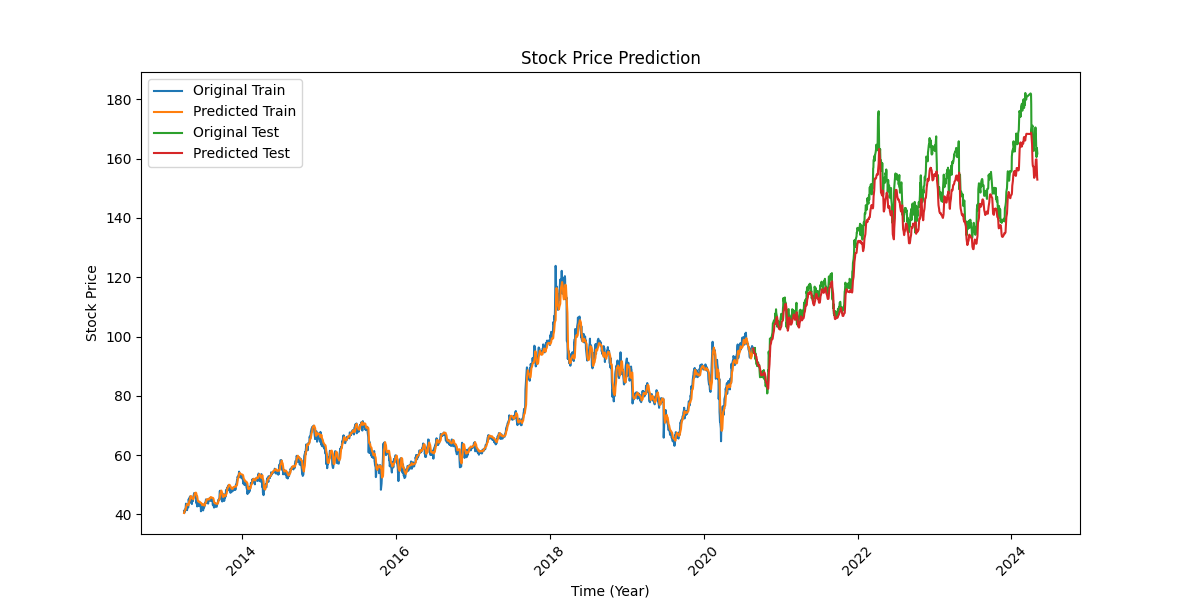

Stock Price Prediction results showing original and predicted values for both training and test datasets.